Lenskold Article Series

by Jim Lenskold

An Executive Summary of the 2006 Marketing ROI and Measurements Trend Study (Marketing Profs)

The buzz about marketing profitability measurement in previous years is certainly turning to action in 2006. At this point, companies not pursuing some form of financial measurements are in the minority. There are still 4 in 10 companies that consider themselves “a long way from where they should be” in terms of their ability to measure financial returns and another 4 in 10 that are “somewhat short of where they could be,” so the industry is in the early stages of the marketing profitability measurement journey.

Our objective of this study was to take the pulse of the industry. The original study in 2005 showed signs of life and now we see a strengthening heartbeat. The progress overall is inspiring and certainly demonstrates an evolution within the marketing practice.

The key findings can be summarized as:

- Capabilities to measure marketing’s impact on financial returns increases significantly since 2005.

Marketers that describe their capability to measure financial returns of marketing as “a real source of leadership” or “as good as they need to be” increased from combined totals of 8% in 2005 to just over 16% in 2006. This was matched with a significant drop in the percentage of marketers describing their capability as “a long way from what it should be” (a decrease from 53% to 42%). - Providing budget for marketing measurement and analytics showed slight improvement but continues to be a problem.

Only 17% of marketers indicate their budget for marketing measurements and analytics is just right. Two out of three (64%) indicate this is slightly or far below the right level. Just 8% believe it is slightly or far above the right level. While it is discouraging to see a gap in the right amount of funding for an investment that can unlock significant profit potential, the glimmer of hope is the improvement over 2005, where 78% had indicated being under-funded. - CEOs and CFOs have increased confidence that marketing investments are profitable, according to marketers surveyed.

The percentage of marketers indicating their CEOs and CFOs are somewhat or very confident that marketing investments are profitable increased from 62% to 71% over the past year. Of the companies reporting they measure marketing profitability, 31% report that their CEO and CFO are very confident compared to 16% of those that do not measure marketing profitability. - The ability to link brand measures to incremental sales and profits has increased over the past year.

Marketers reporting their ability to make this brand measure link as “a real source of leadership” or “as good as it needs to be” increased from a combined total of 6% in 2005 to 15% in 2006. Those who considered their position as “a long way from where it should be” dropped from over two-thirds (65%) in 2005 to 42% in 2006. - Marketing organizations that calculate ROI, net present value or other profitability metrics to assess marketing effectiveness report high CEO and CFO confidence and a high perception of accountability.

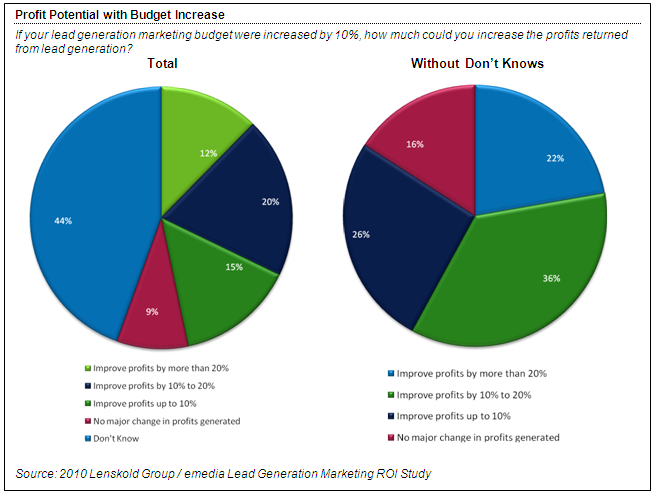

There were 26% of the marketers surveyed that indicated their organizations calculate ROI or similar financial metrics for at least some portion of their marketing campaigns. Of this segment, 31% reported that their CEO and CFO were very confident that their marketing investments were profitable while only 16% of the marketers that do not calculate ROI or similar financial metrics indicated a very high level of confidence. In organizations calculating ROI, 28% of non-marketing executives were reported to view marketing as highly accountable, while this was just 15% in organizations not calculating ROI. One reason this group may be better positioned to calculate the ROI of marketing initiatives is that more reported having the right budget level compared to organizations that do not calculate ROI (26% vs. 15%) - The expected profit potential from improved marketing measurement experienced a sharp jump in the “greater than 25%” category.

When those measuring marketing profitability were asked “If measurements were in place to capture marketing’s contribution to sales, how much profit improvement would you expect?,” the percentage reporting “very high (profit improvements greater than 25%)” increased from 12% in 2005 to 28% in 2006. Another 46% expected increases of 10% to 25% profit improvement. Only 8% believed there was no opportunity for profit improvement. - Those marketing organizations that launch new marketing campaigns using market tests over intuition are even stronger in confidence from the CEO and CFO and are reported to have greater accountability.

One segment from our analysis that stood out was the set of respondents defined as those marketers that answered the question “Which best describes your organization’s typical approach to launching new marketing campaigns?” with the response “campaigns are first market tested to a small segment of the target audience for a quantitative assessment.” Just 14% selected this response and they showed incredibly high performance on our assessment questions compared to the balance of the participants that selected “campaigns are rushed to market based on the limited intuition of a few people” (38%), “campaigns are assessed against a large team’s intuitive knowledge” (30%) or “campaign creative / concepts are tested in qualitative research” (13%).Even more so than the segment of respondents calculating ROI, this segment of “market-testers” showed stronger results in all different areas including greater effectiveness at measuring financial returns, higher incidence of calculation of financial metrics, higher use of marketing methodologies, greater CEO and CFO confidence and better perceptions of being highly accountable. They were also more likely to indicate their marketing measurement and analytics budget was “just right.” Running market tests as part of new campaign launches is not what drives increased adoption of financial measures or even greater credibility with executives. It is however, a good indicator of a marketing culture that values disciplined measurements, ROI analysis, and financial accountability.

In our opinion, the positive momentum identified in this study is likely to continue. Why? Because corporations need sources of profitable growth and improving measurements helps unlock additional profit potential.

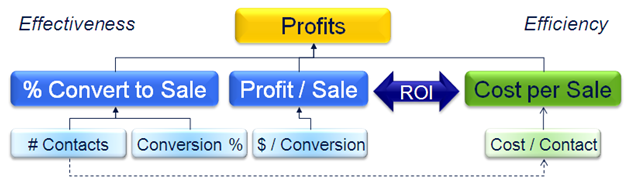

Improvements in data access, analytics, measurements, and financial assessments must continue to be important to move past the noted barriers to measuring marketing profitability. As companies work to make marketing profitability measurement a guide to their growth, they can benefit from the discipline of:

1. Developing better projections of marketing’s financial contribution

2. Creating tighter integration across marketing programs and even with the sales organization

3. Taking a greater role in maximizing customer value

4. Seeking to measure and understand marketing’s impact at a deeper level

Companies that share their marketing ROI success stories at industry events or in articles almost always state that they still have further to go. It’s not because their work is incomplete but because the success they have already achieved makes it clear that additional progress will lead to additional benefits. Look closely at these trends in financial measurements for marketing and, regardless of where you are at on your marketing ROI journey, consider what progress you can make in this and future years.

Access the full report: 2006 Marketing ROI & Measurement Study.

© Lenskold Group Inc. & MarketingProfs, LLC.

Better management of basic measures

Better management of basic measures