In our days of youth, we dreaded the end of summer and the return to school. Now, as marketing and business managers, we have the equally dreadful annual planning and budgeting process that for many starts toward the latter part of summer. CFO Magazine reports that almost half (45%) of financial executives say “budgeting and reporting are contentious, political, and time-consuming.” If the number-loving finance group has this view, you’re not likely to find marketers’ opinions to be any better.

Since planning and budgeting are not going away, you may as well make the effort to get more value out of the process. It’s actually an ideal time for putting basic ROI analysis to use. Here are four ways to use financial insight to create more profitable strategies and tactical plans while building greater credibility with your executive team.

1. Alignment with objectives sets the right stage

Alignment with business objectives and at least a reasonable financial estimate of your impact will enhance your credibility with Finance and the executive team who are determining where in the company to put their limited financial resources. The credibility from showing ROI and contribution to business growth puts marketing on equal footing with other departments, making it more of an investment than a discretionary expense.

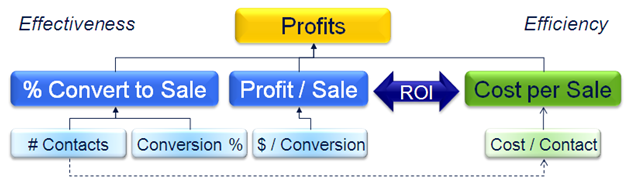

Start by using the best information available to map the impact of your marketing on customer perceptions and behaviors completely through to financial outcomes. Not every marketing initiative directly drives incremental sales, so look beyond this independent initiative and consider how this integrates with other initiatives. It’s helpful to consider the customers’ buying funnel that represents the progression from unaware prospect to profitable customer.

Your plan should state both what your marketing accomplishes on its own and specifically how that contributes to business performance. If you are not sure how your marketing contributes, you quite likely have gaps in your strategies and plans.

Getting an estimated ROI projection from this point can be done two ways:

- The first approach is to compare the cost of your marketing initiative (your investment) to the incremental financial contribution (the profit directly from your initiative or in excess of the profit that would have been contributed without your marketing initiative).

- The second approach is to sum your initiative and the ones that follow (where sales are actually generated) to compare that total investment to the total profits returned.

Yes, there are lots of details to getting these figures precisely right, but running an estimated projection is the start to understanding your profit potential.

2. ROI scenarios lead to better profitability

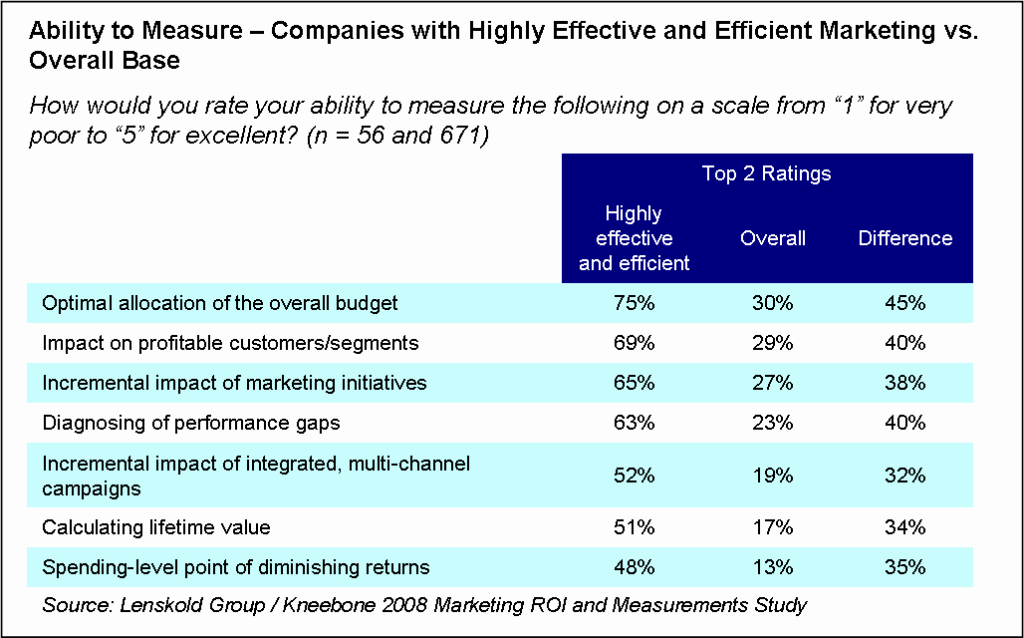

Even if you are working without perfect information, you should be able to at least assess the relative value of your marketing initiatives to improve each, and then prioritize for budget allocation. Run ROI scenarios to understand how changes to your target, marketing mix, offers, integration, and general investment levels change the profit potential.

Be sure to put most of your effort into prioritizing your target market segments, since targeting almost always has the greatest influence on ROI. You need to concentrate your efforts on not only high-value customers but also high-potential customers—the ones you can cost effectively motivate to choose your products and services.

The final budget allocation needs to reflect the business objectives for balancing short-term and long-term results. It should also have an appropriate mix of proven marketing initiatives (low risk) and new initiatives that are innovative and high potential (high risk).

Some 72% percent of the financial executives surveyed by CFO Research Services say that “planning and budgeting information is unrealistic or irrelevant,” either frequently (27%) or occasionally (45%). Of course, marketing always has unknowns, such as customer response, marketing effectiveness, and competitive activity, but smart marketers will make their estimates as realistic as possible. You’ll use the best assumptions you can, maybe tapping further into historical data or custom research.

The more your ROI analysis can represent your expectations of marketing performance, the easier it will be to refine those assumptions and adjust your marketing decisions. Plus, the exercise to estimate the financial outcomes of your marketing investments will help identify information gaps, leading to the next action item presented in this article.

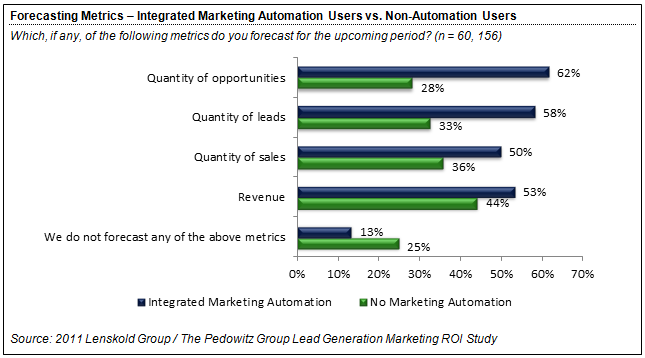

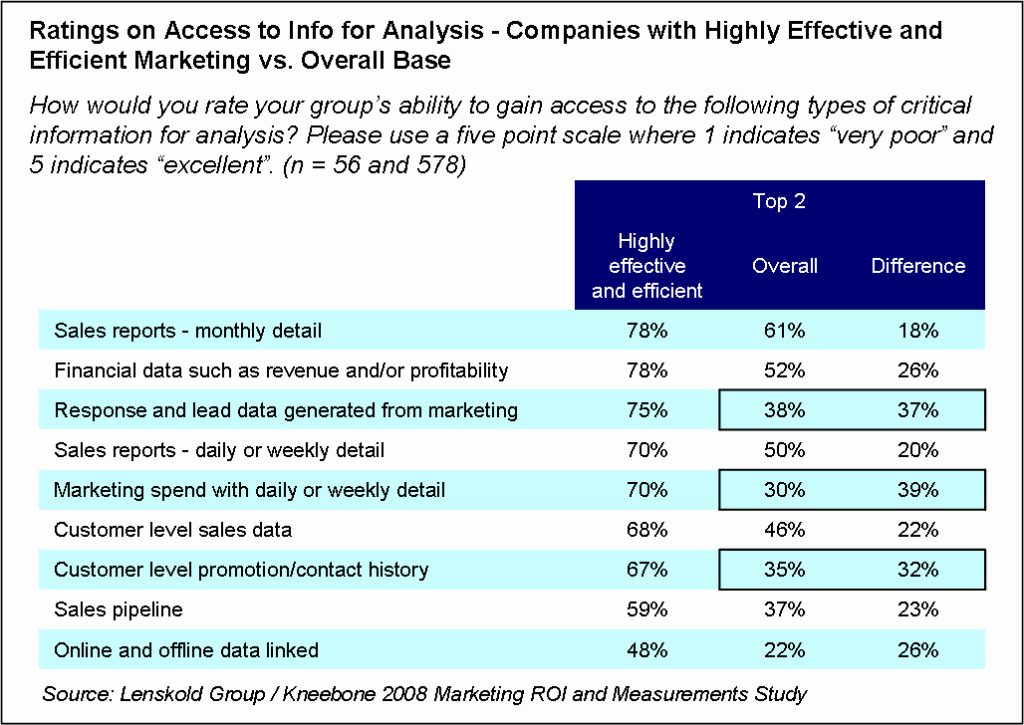

3. Better insight today makes for better decisions tomorrow

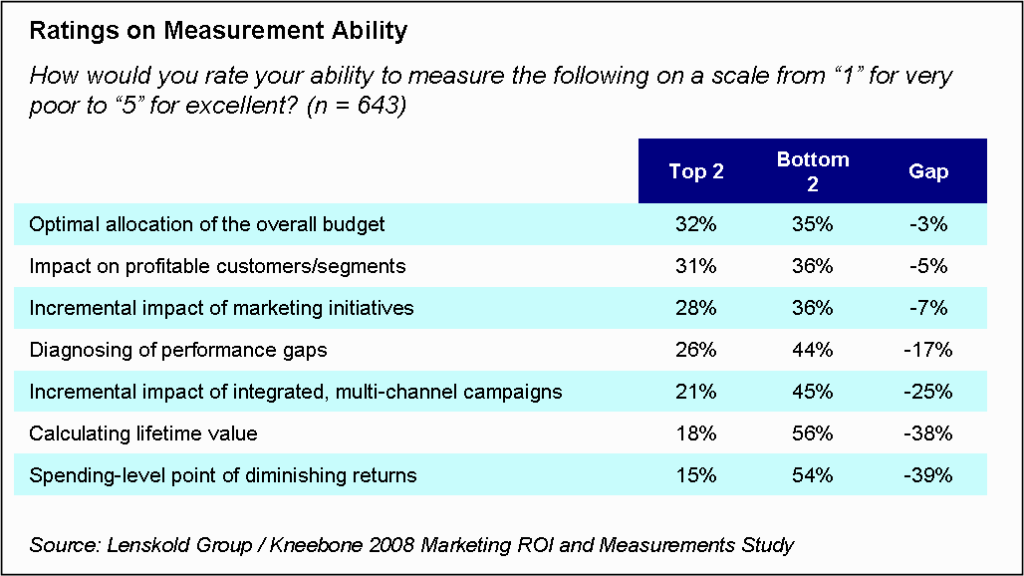

One of the reasons the planning process is so painful is that there is rarely enough quality research and analysis to make informed decisions. Instead of finding yourself in that same position again next year, incorporate greater learning into the plan you are developing.

Granted, it’s not easy to pull budget from revenue-producing marketing activities to fund measurements and analysis. What you have to consider is that (1) the value of some marketing initiatives is already questionable; (2) in most cases the insight gained will pay back with more effective marketing in the current or following year; and (3) plenty of new insights can be gained with little or no incremental budget if you take the time to plan right.

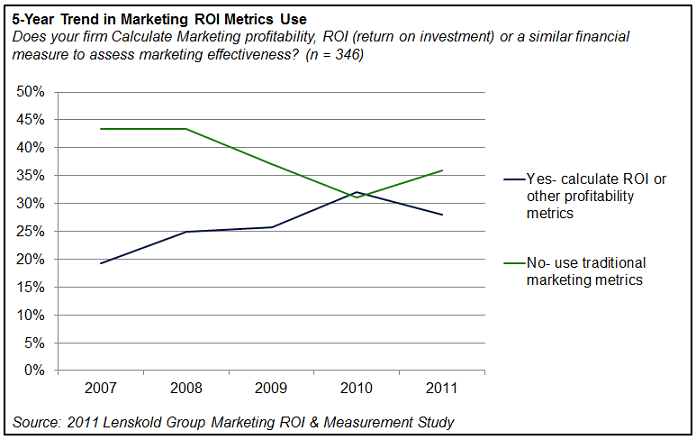

4. Use the right metrics in the right way

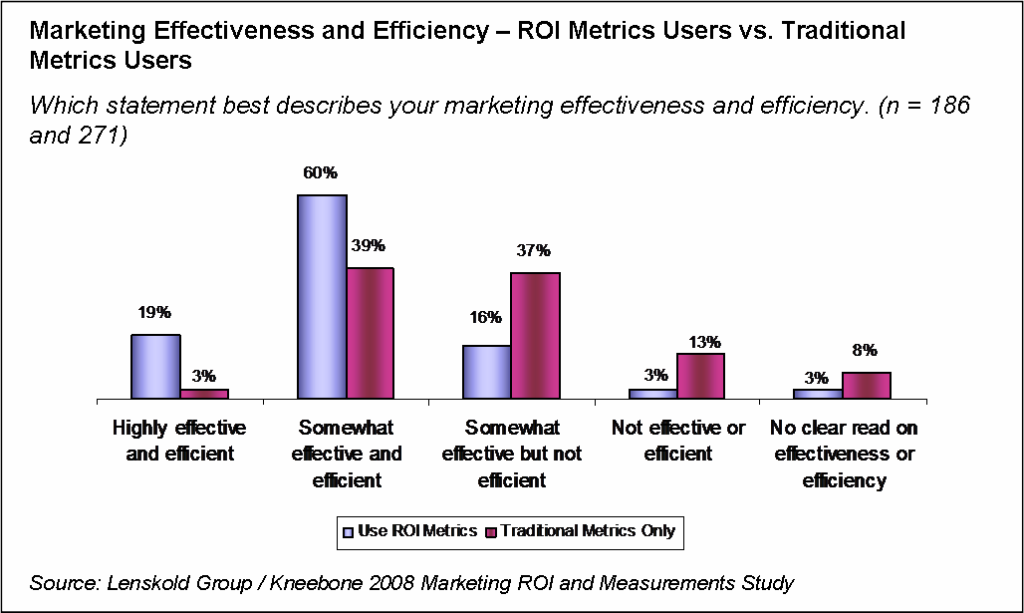

Finally, you want your success metrics to be aligned with business objectives as well. There are a lot of dynamics involved in properly setting goals and objectives, and we’re only going to touch on one key point here. The marketing organization as a whole must reach the point where the primary goals contribute to the business objectives of profits and growth (both short term and long term).

Performance metrics, such as awareness, audience reach, advertising recall, and even leads generated, are critical for knowing whether you are on track to deliver on those goals. But be careful not to let performance metrics become your goals. Keep in mind that executives feel less pain when they cut budgets that have no clear connection to business objectives.

Conclusion

The planning and budgeting process apparently brings out the worst in us. Over half (53%) of the financial executives surveyed by CFO Research Services say the budgeting process “encourages undesirable behaviors among managers.”

Besides the gaps in data, performance measurements, and analyses that limit the accuracy of annual marketing plans and forecasts, there are also corporate culture issues that come into play. Executives engage in wishful thinking and push managers to deliver more results with less budget, while managers seek to under-commit and over-perform, especially where bonuses are dependent on the final plan.

For now, let’s focus on using quality ROI analytics to improve both our accuracy and our credibility. Let’s also try to act on our best behavior.