Lenskold Article Series

by Jim Lenskold

Maximizing Lead Generation Marketing ROI Part 4: Dashboard Metrics

This is the fourth article in the four-part series on Maximizing Lead Generation Marketing ROI. The other articles in this series include:

Part 1: Lead Quality Counts

Part 2: Insight, Alignment & Action

Part 3: Measuring Effectiveness

In addition to measurements for specific tactics, which we covered in Part 3 of this 4-part series, marketing executives must be attentive to overall performance management. This involves monitoring and measuring key metrics to understand the collective impact of all marketing and sales efforts, to ensure business goals can be met, and to support business decisions.

The objective of our dashboard metrics is not reporting as much as capturing insight that can be used to improve performance. You want to select and define a set of metrics that 1) collectively reflects what is driving financial performance, 2) shows early indicators of future performance and 3) identifies specific areas of weakness where improvements can be beneficial. In this article, I’ll define 17 metrics specifically for lead generation marketing, which you can consider as you develop your performance management dashboard.

Framework for Key Metrics

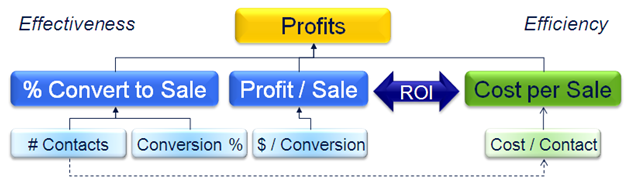

Lead generation marketing plays the critical role of surfacing and engaging potential buyers to provide new and better prospects for the sales organization. For lead generation, key metrics must provide insight into lead quantity, lead quality, lead outcomes, and cost management. In addition to managing total leads to ensure business goals are met, the most critical metrics are those that assess marketing effectiveness in contributing to the primary profit drivers for the business, which include, 1) sales conversion rate, 2) incremental profit per customer, and 3) the cost per sale (see diagram below).

Lead Generation metrics can be organized into the following categories:

- Funnel progression metrics – covering conversion rates from initial contact through closed sale

- Customer value metrics – covering the financial value that results from the leads generated

- Cost management metrics – covering the expense side

- Goal attainment metrics – ensuring quantity and quality come together to meet business objectives

Funnel Progression Metrics

We can break funnel progression metrics into the following four sub-categories that provide insight into conversion quality:

- New Leads

- Sales Acceptance

- Sales Readiness

- Purchase Velocity

For each of these, we have a number of key metrics to consider.

New Leads

This first set of metrics is used to assess marketing effectiveness in terms of generating the right number and the right type of leads.

Marketing Qualified Lead Rate combines several stages in the funnel to incorporate a quality component into the marketing effectiveness assessment. This metric looks at the number of marketing qualified leads (MQLs) that are generated from all marketing contacts. This ratio improves as your marketing initiatives become more effective at generating more qualified leads, or more efficient at screening out low potential contacts.

Marketing Qualified Lead Rate = # of MQLs / # of total marketing contacts

Example – Direct marketing campaign promoting Webinar

10,000 contacts reached

800 Webinar participants

200 marketing qualified leadsMarketing Qualified Lead Rate = 200 / 10,000 = 2%

As an alternative, you can split the marketing qualified lead conversion metric into two metrics. This will provide more detail but the metrics must be used with caution, since improvements to the single metric may not align to improved business results. You will see that the two examples below match up to the example above.

Engagement Rate, in some cases referred to as a response rate, indicates how well Marketing generates some form of action from its targeted contacts. It is focused more on lead quantity than lead quality. Some marketing programs will generate fewer, high quality leads while others will attract a high response among lower quality of leads. This metric can be used to diagnose problem areas or compare how different marketing programs can be used in the marketing mix but is a low priority metric in terms of managing lead quality and goal attainment.

Engagement Rate = # of contacts taking action / # of marketing contacts

Example – Direct marketing campaign promoting Webinar

10,000 contacts reached

800 Webinar participantsEngagement Rate = 800 / 10,000 = 8%

Lead Qualification Rate is used with the engagement rate metric to determine how many of the “engaged” contacts qualify for Marketing to hand off to Sales. This screening step is not always included as a marketing responsibility, however, as we have noted in the first three articles of this series, it is a step that significantly impacts marketing profitability.

Lead Qualification Rate = # of marketing qualified leads (MQLs) / # of leads generated

Example – Webinar participants qualified via marketing screening process

800 Webinar participants

200 marketing qualified leadsLead Qualification Rate = 200 / 800 = 25%

Sales Acceptance

Sales acceptance of marketing-generated leads is the next critical step in the process. If Sales is rejecting or even ignoring marketing leads, the marketing budget is not likely to be generating good ROI. The definitions for marketing qualified lead screening should align to the requirements for sales qualified leads (although not as strict).

Sales Acceptance Rate is one of the best indicators of lead quality, and could easily be labeled as the “Lead Quality” metric. It is the ratio of sales qualified leads to marketing qualified leads. It serves as an excellent indicator of how well Marketing is qualifying and screening leads to maintain high quality levels. A good target to aim for is 70% – 80% MQL to SQL.

Sales Acceptance Rate = # of Sales Qualified Leads (SQLs) / # of MQLs

Example – Marketing qualified leads from Webinar passed to Sales

200 MQLs passed to Sales

120 leads accepted as SQLsSales Acceptance Rate = 120 / 200 = 60%

Opportunity Rate tracks lead quality at a more precise level than the Sales Acceptance or Marketing Qualified Lead Rate metrics. Opportunities are typically defined by the Sales organization as leads that have clearly defined needs, purchasing authority, an expectation to purchase within a reasonable time period, and budget. This metric is assessing Marketing’s ability to generate leads that are generally ready to buy. It is based on the percent of leads generated converting to an opportunity.

Opportunity Rate = # of Opportunities / # of MQLs

Example – Marketing qualified leads passed to Sales and qualified as opportunities

200 MQLs passed to Sales

80 leads converting to OpportunitiesOpportunity Rate = 80 / 200 = 40%

You can substitute number of leads generated in place of the number of MQLs passed to Sales if that works better for your organization.

Sales Pipeline Metrics

Too often, Marketing does not have system access to track their leads through the sales pipeline. As we have established in the first three articles of this series, Marketing must have insight into and contribute to influencing prospects at all stages of the purchase funnel. Marketing can have a significant role in creating “sales readiness,” especially in those firms making the argument to invest in branding to create stronger differentiation, and the best measures to understand the impact of those efforts are in the conversion rates within the sales funnel. The other significant benefit in tracking sales conversion rates is to understand sales effectiveness and where additional marketing support can improve the net sales rate (remember from Part 1 that improving conversion rates late in the purchase funnel has high ROI potential).

Opportunity to Close Rate summarizes the overall sales pipeline performance from the point of identifying a viable buyer to winning the sale. This can be further split into conversion rates for each major stage in the pipeline (such as opportunity to meeting, meeting to proposal, proposal to close) to provide more detail, but these two points work fairly well in representing the area that Sales manages. This detail is extremely valuable in diagnosing weak areas in the sales cycle.

Opportunity to Close Rate = # of Closed Sales / # of Opportunities

Lead to Close Rate (or Lead to Purchase Rate) captures the net outcome of the leads generated. This assesses how many leads passed to sales (MQLs) convert into sales.

Lead to Close Rate = # of Closed Sales / # of MQLs

Sales Capacity (or # of Leads per Rep) is also a good indicator of sales performance. This is the number of active leads managed divided by the number of sales people managing those leads. There is a point where the number of active leads begins to hurt sales effectiveness and this metric should show when that point is reached.

Sales Capacity = # of Active Leads / # Sales Reps

Purchase Velocity

Monitoring the pace of leads moving through the sales cycle provides additional insight that is often missed. There are two high priority metrics in this category.

Lead Contact Velocity is the average number of days between leads being handed off to Sales and Sales making initial contact (or contact attempts). It is an excellent indicator of sales capacity and can help in understanding why lead quality might mistakenly be viewed as declining. We had a client who could not determine why fewer and fewer leads were converting to opportunities, only to discover that the average days for the first contact had changed from 3 days to 14 days.

Lead Contact Velocity = Average # of Days from lead passed to lead contact

Lead to Close Velocity, also referred to as the sales cycle time, is the average number of days between a lead being handed off to Sales, and the closed sale date. As the sales cycle duration increases, it increases the cost to the sales organization, increases the number of active leads that need to be managed, and typically means a lower sales conversion rate. This metric lets the marketing organization know if additional effort needs to be put against sales readiness, or if additional tactics are necessary within the sales pipeline.

Lead to Close Velocity = Average # of Days from lead passed to closed sale

Customer Value Metrics

In addition to conversion rates, the other component of lead quality is customer value. By “value,” we are referring to the incremental profits generated from new customers and/or new sales. While revenue and sales volume are important, we must get to profits if we are going to assess ROI and ensure that our marketing programs generated more than we spent.

Customer value metrics help the marketing organization 1) improve targeting, 2) improve effectiveness in attracting higher value leads, and 3) improve customer purchase decisions to buy more or buy higher value products and services.

Average Profit per Customer should consist of the net present value of incremental customer profits generated as a result of this campaign. It encompasses the current purchase and the repeat purchases likely to follow (without additional investment in up-selling and cross-selling). This metric could easily be modified to alternatives such as Average Profit per Sale (if buyers are not known or tracked), or Average Profit per First Time Buyer.

Average Profit per Customer = total incremental profits / # of customers buying

Other metrics that reflect specific portions of customer value include Retention Rate (or Repeat Purchase Rate), Average Profit per Order, and Average Orders per Year (or any other time period).

Cost Management Metrics

You want to be careful with cost metrics since any positive changes to conversion rates or customer value can easily justify increased costs. However, you do want to look for opportunities to generate the same lead quality with less expense.

The three cost management metrics that each show a slightly different perspective are

Cost per MQL, Cost per Opportunity, and Cost per Sale.

Cost per MQL (or Cost per Lead if you do not have a qualification stage) provides a very narrow, marketing-only perspective that ends with the marketing leads. It is okay but not ideal.

Cost per MQL = Total Marketing Cost / # of MQLs generated

Cost per Opportunity is probably the best metric for lead generation marketing since it sets the objective that leads should be screened and nurtured properly and ready for the sales cycle.

Cost per Opportunity = Total Marketing Cost / # of Opportunities from MQLs

Cost per Sale is another excellent metric which provides an integrated Marketing and Sales perspective. This includes both the marketing and sales expense so it motivates Marketing to provide fewer, better leads.

Cost per Sale = Total Marketing & Sales Cost for a set of leads / # of closes sales from the same set of leads

Goal Attainment Metrics

All of the metrics so far provide insight into your effectiveness and lead quality, but it is possible to improve quality and then not have enough leads to reach your goals. This last set of metrics helps ensure that you (Marketing and Sales together) are on track to meet the financial objectives of the company.

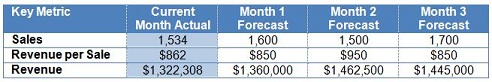

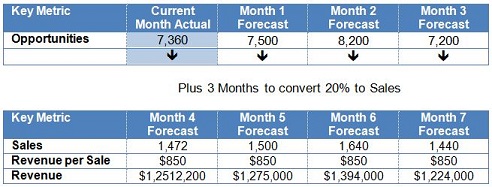

Number of Active Leads per Period lets the marketing organization know if there are enough leads to reach the sales goals for upcoming periods. This metric can indicate a sales capacity issue when too high, letting Marketing know to reduce new leads. You could use the metric Lead Volume per Period, which represents the total number of new leads that Marketing delivers to Sales, but that does not take into consideration sales capacity and does not ensure there are enough leads in the pipeline to generate the right number of sales.

Number of Active Opportunities per Period is an alternate version that will be more predictive of future sales volumes. For either metrics, the sales organization should know how many active leads or opportunities are necessary to meet closed sales goals. This is determined by using your target number of closed sales and your conversion rate. For example, if your Opportunity to Close Rate is 10% and your target sales for each month is 20, then at any given time, the sales organization needs to have 200 active opportunities. This is calculated by dividing the sales goal by the conversion rate (20 / 10% = 200). The time period is not relevant as long as the Lead to Close Velocity remains steady.

Projected Profit per Active Opportunity is the ideal metric to monitor the financial value of the pipeline. It is used in conjunction with the Number of Active Opportunities per Period and the Opportunity to Close Rate to forecast the future flow of profits from new sales. Realistically, this is more often tracked as projected revenue per opportunity. While revenue does not show the true relative value of different opportunities, it tends to fit the sales management process well.

Total Sales Volume per Period is an important outcome metric that is used with the Average Profit per Customer to manage the financial performance from new sales.

Metrics Selection

We’ve covered a good set of metrics in several categories to monitor and manage overall lead generation performance. These metrics extend into the sales pipeline, which is required to truly manage the marketing impact on business outcomes, so work must be done to set up access and tracking.

Your primary metrics should be as comprehensive as possible in covering lead quality (conversion rates and customer value), cost management, and goal attainment (lead quantity). Each marketing organization will have a unique set of metrics. Your final set of metrics will be determined by:

- The availability of the right data to track lead outcomes, including the sales pipeline

- The quality of tracking data since you need to avoid using data that will report inaccurate metrics

- The customer relationship, since the detail of tracking data is dependent on your ability to know progression through the funnel stages

- Your decision process, since your dashboard and metrics should be defined based on how the marketing organization makes decisions to manage their performance.

This concludes our 4-part series on Lead Generation ROI. There is clearly a significant opportunity to improve the ROI of lead generation marketing with better measurement and management processes. Whether it is better alignment with sales, better metrics, or leveraging new insights to guide marketing strategies and tactical decisions, every step forward will result in improved marketing performance and profitability.

Better management of basic measures

Better management of basic measures